Long term public debt issues

The main driver behind the group's debt requirement is the capital investment programmes of United Utilities Water Limited. The group has begun funding its AMP8 (2025-30) investment programme and at 31 March 2025 had liquidity extending into 2027.

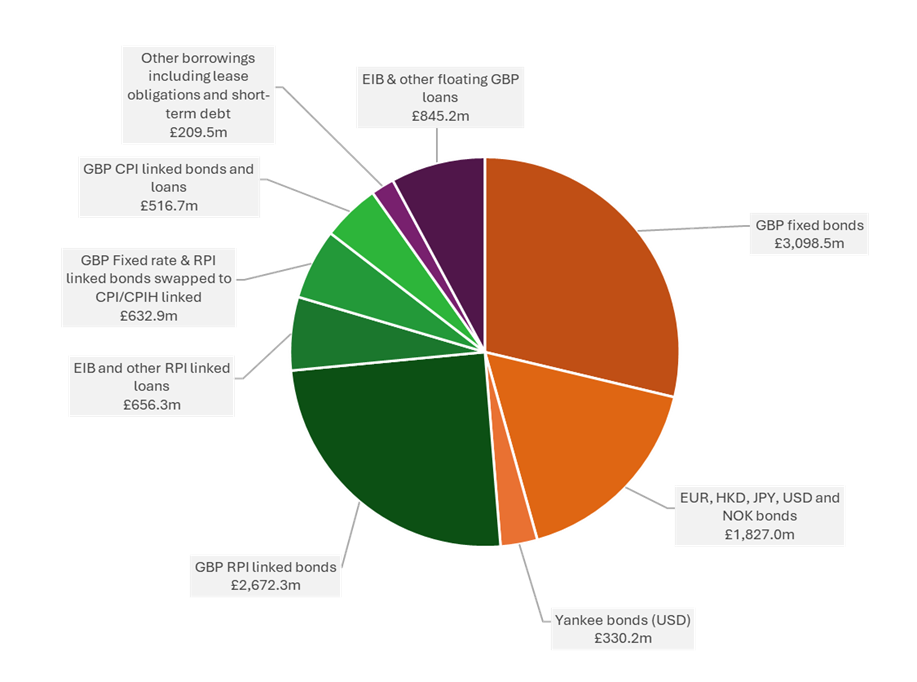

Below is a chart detailing our gross debt position as at 31 March 2025.

Gross Debt = £10.8bn

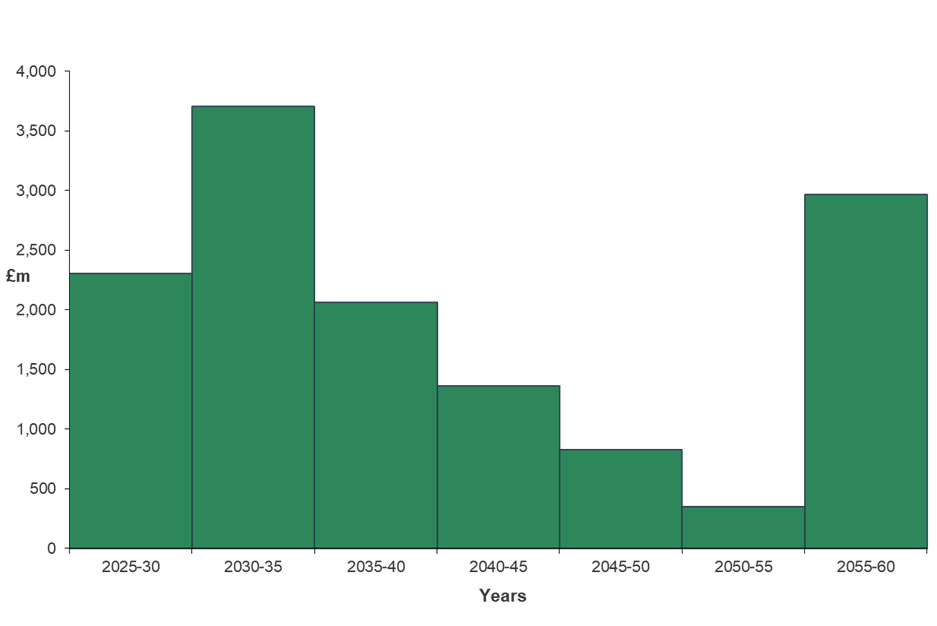

Below is a chart detailing our term debt maturity profile as at 31 March 2025.

Average term to maturity of approximately 15 years

Yankees

More information on long term public debt issues - Yankees

Euro medium term notes

More information on long term public debt issues - Euro medium term notes

Detailed borrowings information

Details of our borrowings including terms and maturities