I'm thinking of retiring

The following explains the choices available to you at retirement, and when your DC pot can be paid.

- The earliest you can retire is age 55

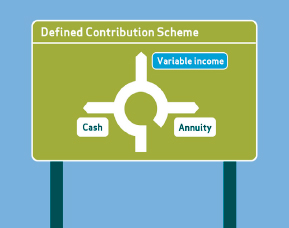

- At retirement you have three options (or a combination)

DC retirement options

1. Cash – you could take your entire pension savings as a cash lump sum (with 25% tax free and the remainder taxed as income)

2. Secured Income (Annuity) - you could take a cash lump sum of 25% (tax free) and use the remaining pension pot to purchase a regular income that provides you with the type of income you want for the rest of your life.

3. Flexible Income (Drawdown) – you could take a cash lump sum of 25% (tax free) and use the remaining pension savings to provide an annual taxable income – which you could vary from year to year.

Don’t worry, when you decide to retire our retirement adviser will help you choose the option that works for you.

What do I need to do to retire?

If you are thinking about retiring you should contact Aegon (formerly BlackRock) in the first instance. Your details will be passed on to Hargreaves Lansdown, a specialist company appointed by the Trustee. Hargreaves Lansdown will contact you automatically to talk you through your options and guide you through the process.

Once you know what you wish to do and when, you should write to your line manager (either by letter or email) to tell them you want to retire, and the date you wish to leave.

If you have any queries please contact the Scheme Administrator Aegon in the first instance. Aegon will deal with your query if possible or ensure that someone within United Utilities does so.

Aegon Workplace Investing, PO Box 17486, Edinburgh, EH12 1NU

Tel: 01733 353481